| | | Abraxas Petroleum Corp. Approach Resources, Inc.

Callon Petroleum Co.

Constellation Energy Partners, LLC

Crimson Exploration Inc.

Dorchester Minerals, L.P.

| | Double Eagle Petroleum Co. | Approach Resources, Inc. | Gastar Exploration Limited | Callon Petroleum Co. | GeoMet Inc. | Constellation Energy Partners, LLC | Matador Resources Company | Credo Petroleum Corp. | PetroQuest Energy Inc. | Crimson Exploration Inc. | PrimeEnergy Corp. | Dorchester Minerals, L.P. | Warren Resources, Inc. |

Since the Company is not the same size and does not have the complexity of operations as most of the peer companies, the Compensation Committee uses the peer group comparison as a tool while considering allmany other factors. Executive officer salaries are below peer group averages as a whole. (18)

Base Salaries. The base salaries of the executive officers are reviewed annually by the Compensation Committee and future salary adjustments, if any, are recommended to the Board for final approval. The Compensation Committee and the Board consider various factors, including: | · | | overall responsibilities of the executive officers; |

| · | | scope, level of experience and expertise required to successfully execute the executive officer’s position with the Company; |

| · | | demonstrated individual performance of the executive officer; and |

| · | | recommendation of the Chief Executive Officer with respect to other executive officers. |

time period over which the executive officer has performed his responsibilities for the Company;

scope, level of experience and experience required to successfully execute the executive officer’s position with the Company;

demonstrated individual performance of the executive officer; and

recommendation of the Chief Executive Officer with respect to other executive officers.

Based on these factors and considerations, in December 2011, the Board established the annual base salary for the Chief Executive Officer at $291,000 for calendar 2012. Calendar 2012 base salaries established for the other executive officers were: Paul F. Blanchard—$270,000; Lonnie J. Lowry—$179,000; Ben Spriestersbach—$145,000; and Robb P. Winfield—$140,600. Salaries for the executive officers in fiscal 20112013 are set forth below in the “Executive Compensation—Compensation - Summary Compensation Table” and were determined by the Board based on the considerations described below.above. Based on the above factors and considerations, in December 2013, the Board established the annual base salary for the Chief Executive Officer at $310,000 for calendar 2014. Calendar 2014 base salaries established for the other executive officers were: Paul F. Blanchard - $286,500; Lonnie J. Lowry - $185,700; Ben Spriestersbach - $153,000; and Robb P. Winfield - $151,500.

Annual Cash Bonuses. During an annual Company goal-setting process, the Compensation Committee and the full Board approve Company objective performance metrics as well as more subjective performance goals that focus on the manner in which the Company’s oil and gas business is managed. These performance metrics are used in determining annual cash bonuses. For fiscal years 20102013 and 2011,2012, the objective performance metrics addressed earnings per share, general and administration (“G&A”) expense, reserve replacement percentage, McfeMmcfe production, and finding cost per Mcfe.Mcfe and total G&A expense. The objective performance metrics for fiscal 20112013 and fiscal 20102012 are below: | | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiscal 2011(1) | | | Fiscal 2010(2) | | Metric Category | | Floor | | | Target | | | Weighting | | | Floor | | | Target | | | Weighting | | Earnings per share(3) | | $ | 0.25 | | | $ | 1.09 | | | | 14 | % | | $ | 0.01 | | | $ | 0.52 | | | | 14 | % | Reserve replacement percentage | | | 124 | % | | | 175 | % | | | 29 | % | | | 100 | % | | | 137 | % | | | 22 | % | Mmcfe production | | | 8,916 Mmcfe | | | | 9,629 Mmcfe | | | | 14 | % | | | 7.92 Mmcfe | | | | 8.42 Mmcfe | | | | 14 | % | | | | | | | | | | | Maximum | | | Target | | | Weighting | | | Maximum | | | Target | | | Weighting | | Finding cost per Mcfe | | $ | 2.25 | | | $ | 1.60 | | | | 36 | % | | $ | 2.75 | | | $ | 2.25 | | | | 43 | % | G&A expense per Mcfe of production(4) | | $ | 6.2 mil | | | $ | 5.8 mil | | | | 7 | % | | $ | 0.77 | | | $ | 0.51 | | | | 7 | % |

(1) | Once the Floor or Maximum is achieved within each Metric Category, 50% credit is earned, with the remaining 50% to be prorated based on the proportion achieved between the Floor or Maximum and the Target. |

(2) | Each metric has a graduated scale of achievement from -0- to 100% between the Floor or Maximum and Target amounts which is then applied to the weighting percentage |

(3) | 2011 Earnings per share is net of the tax effected net change during fiscal 2011 in receivables and payables related to derivative contracts. |

(4) | Fiscal 2011 metric is based on total G&A expense whereas the fiscal 2010 metric was based on G&A expense per Mcfe of production. |

| | | | | | | | Fiscal 2013 | Fiscal 2012 | Metric Category | Minimum(1) | Target(1) | Weighting | Minimum(1) | Target(1) | Weighting | Earnings per share (1)(3) | $0.50 | $0.91 | 7% | $0.25 | $1.05 | 14% | Reserve replacement percentage (1) | 125% | 175% | 29% | 175% | 200% | 22% | Mmcfe production (1) | 10,901 | 11,430 | 7% | 8,923 | 9,636 | 7% | | Maximum(2) | Target(2) | Weighting | Maximum(2) | Target(2) | Weighting | Finding cost per Mcfe (2)(4) | $1.50 | $1.10 | 50% | $2.25 | $1.60 | 50% | Total G&A expense (2) | $6.7 mil | $6.4 mil | 7% | $6.4 mil | $6.0 mil | 7% |

(19)(1)If the Target is achieved in any metric category covered by a Minimum measurement, 100% credit is earned. If the Minimum is achieved for any of these metric categories and the Target is not achieved, 50% credit is earned, with the remaining 50% based on the proportion achieved between the Minimum and the applicable Target. If the Minimum is not achieved in a metric category, no credit is earned.

(2)If the Maximum is exceeded for these two metric categories, no credit is received for the affected metric category. If the Target is met for these metric categories, 100% credit is earned. If the amount achieved is below the Maximum for any of these metric categories and the Target is not achieved, 50% credit is earned, with the remaining 50% based on the proportion achieved between the Maximum and the applicable Target.

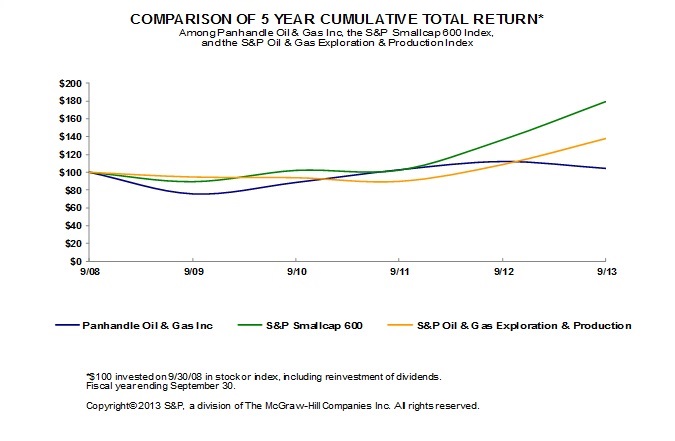

(3)Earnings per share is net of the tax effected net change during the fiscal year in receivables and payables related to derivative contracts. (4)Finding cost per Mcfe is defined by the Compensation Committee and takes into account only changes in proved developed reserves and utilizes the ratio of SEC reserves oil and NGL prices to SEC reserves natural gas price as the factors to convert oil and NGL reserves to Mcfe reserves. The Compensation Committee believes that combining the metric categories of growing reserves, increasing Mcfe production, reducing theminimizing finding cost per Mcfe and reducingmanaging G&A expense are the important measurements necessary for increasing shareholder value and to grow an oil and gas exploration and production company. The target metric of reducingminimizing finding cost per Mcfe is intended to discourage drilling marginal or unprofitable wells only to achieve increased production and reserves. These metrics have been adopted by the Compensation Committee to focus management on drilling wells that are economically viable.viable and generate a reasonable rate of return for the Company. The emphasis on the earnings per share metric has the effect of discouraging excessive risk taking. The Compensation Committee does not believe that these performance metrics reward executives for taking risks beyond those risks inherent in the oil and gas exploration and production business. The Compensation Committee has the discretion to modify the effect of the objective performance metrics if unforeseen or uncontrollable conditions resulted in any of these metrics not being satisfied.relevant to the Company’s results for the year. The subjective performance goals are tailored to fit the job description of each executive officer by weighting each major area of responsibility. Within each major area, a breakdown is made of more detailed areas of responsibility with weighting applied to each.responsibility. An evaluation of the Chief Executive Officer is performed annually by the Compensation Committee. The Chief Executive Officer performed the evaluation of each of the other executive officers. In these evaluations, performances are evaluated on each of the detailed areas of responsibility. The evaluations are then accumulated to determine the grade for each major area and the area grading is summarized to determine the executive officer’s subjective performance evaluation total score. The Committee reviewed the performance of the Chief Executive Officer in meeting the Company’sCompany’s performance metrics and his subjective performance goals for fiscal 2011.2013. In addition, the Committee noted that the Company’sCompany’s share price had outperformedunderperformed both the S&P Small Cap 600 and the S&P Oil and Gas Exploration and Production Indexes for fiscal 2011.2013. The Company’sCompany’s share price increased 15%decreased 8% during fiscal 2011.2013. The Committee believes that this underperformance was principally due to the Company being primarily a natural gas producer which is out‑of‑favor in the marketplace. Natural gas prices have been depressed for several years but recently have been increasing. The Committee placed emphasis on the excellent performance metric results while believing the Company’s natural gas assets will provide excellent returns for the Company’s shareholders over a longer horizon.

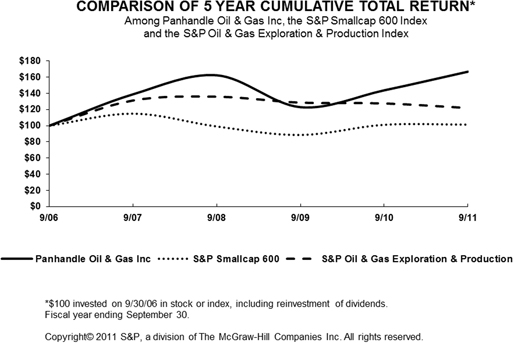

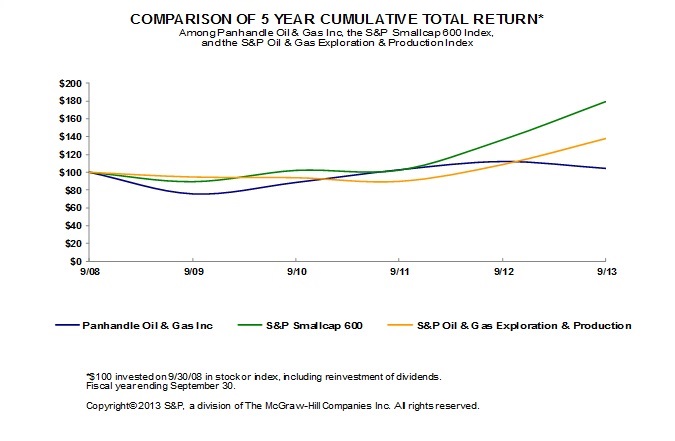

compare the $16.57 price mentioned above to a closing price on November 29, 2013 of $33.10 per share. The graph below matches Panhandle Oil & Gas Inc's cumulative 5-Year total shareholder return on common stock with the cumulative total returns of the S&P Smallcap 600 index and the S&P Oil & Gas Exploration & Production index. The graph tracks the performance of a $100 investment in our common stock and in each index (with the reinvestment of all dividends) from 9/30/2008 to 9/30/2013.

| | | | | | | | | | | | | | | 9/08 | 9/09 | 9/10 | 9/11 | 9/12 | 9/13 | | | | | | | | Panhandle Oil & Gas Inc | 100.00 | 75.70 | 88.52 | 102.73 | 112.10 | 104.39 | S&P Smallcap 600 | 100.00 | 89.39 | 102.10 | 102.31 | 136.43 | 179.43 | S&P Oil & Gas Exploration & Production | 100.00 | 94.64 | 93.90 | 89.75 | 108.55 | 137.89 |

(20)

The stock price performance included in this graph is not necessarily indicative of future stock price performance.The Compensation Committee believes that the cash bonus element of compensation for Mr. Coffman, Chief Executive Officer, and Mr. Blanchard, Chief Operating Officer, should principally reflect their success in achieving the above outlined Company performance metrics. Their bonus calculation is based on a weighting of 70% for meeting the objective performance metrics and 30% for meeting their subjective performance goals.

Cash bonuses are paid in the first fiscal quarter (December) of each year based on the preceding fiscal year’s metric results. Thus, bonuses paidawarded in fiscal 2013 (paid in December 20102012) were based on the following fiscal 20102012 metric results. For fiscal 2010, the metric results were as follows: Fiscal 2010

| | | | | Metric Category | Actual Results | Target | Earnings per share | $ | 0.91 | $ | 1.05 | Reserve replacement percentage | | 223% | | 200% | Mmcfe production | | 10,583 | | 9,636 | Finding cost per Mcfe | $ | 1.53 | $ | 1.60 | Total G&A expense | $ | 6.4 mil | $ | 6.0 mil |

| | | Metric Category

| | Actual Results | Earnings per share

| | $1.36 | Reserve replacement percentage

| | 505% | Mmcfe production

| | 8,927 Mmcfe | Findings cost per Mcfe

| | $0.29 | G&A expense per Mcfe of production

| | $0.59 |

The maximum targeted annual cash bonus that could have been paid in December 20102012 to the Chief Executive Officer (based on fiscal 20102012 results) was 100% of his $291,000 base salary ($260,000).salary. The maximum targeted annual cash bonus that could have been paid in December 20102012 to the Chief Operating Officer (based on fiscal 20102012 results) was 75% of his $270,000 base salary ($240,000).salary. The other executive officers’ annual bonuses were targeted at 30% of base salaries and were based 80% on meeting subjective performance goals and 20% on meeting Company objective performance metrics. Cash bonus payments made during the first fiscal quarter of 20112013 (December 2010)2012) are set forth below in the Summary“Summary Compensation TableTable” under “Executive Compensation”. | Long-Term Equity-Based Compensation |

Our executive officers are eligible to receive stock-based awards under our Restricted Stock Plan. The objectives of the Restricted Stock Plan are to attract and retain key employees, to motivate them to achieve long-range goals and to reward individual performance. Because executives’ compensation from stock-based awards is heavily weighted to our stock price performance, the Compensation Committee believes stock-based awards create a strong incentive to improve long-term financial performance and increase shareholder value. Factors used to set the range of stock-based awards include management’s and the Compensation Committee’s perception of the incentive necessary to motivate individuals to join the Company and the role and impact of the various management levels in achieving key strategic results. Awards made to executive officers in fiscal 2013 consisted entirely of restricted stock awards which were made under the Restricted Stock Plan. Vesting provisions contained in the stock restriction agreements for restricted stock awards are used by the Compensation Committee as another method to tie executive compensation both to continuing service by the executive to the Company and to the growth in shareholder value, as measured by the market price of the Company’s shares. Under various circumstances, the restricted stock awards may vest totally, partially or not at all. A portion of these restricted stock awards vest if the executive officers remain employees of the Company for the vesting period. These time vested stock awards are forfeited if the officer does not remain employed for the vesting period. The Compensation Committee believes a three-year vesting schedule for restricted stock awards enhances the retention value of these awards and positions the Company competitively from a market perspective. For a description of the stock-

based awards under the Restricted Stock Plan, see the table entitled “Outstanding Restricted Stock Awards” on page 16. Longnecker reviewed the total direct compensation packages of our executives, including our stock-based award program and recommended the Committee consider maintaining the use of restricted stock awards. The Compensation Committee relied upon the market data, company performance, and individual performance in the determination of stock-based awards for our executive officers. After considering all of these factors, in fiscal 2013, our committee approved the following restricted stock awards, which vest over a three year period: Michael C. Coffman, 13,361 shares; Paul F. Blanchard, 10,476 shares; Lonnie J. Lowry, 935 shares; Ben Spriestersbach, 1,285 shares; and Robb P. Winfield, 748 shares. The Company’s clawback policy further aligns the interests of our executives with shareholders. Under our clawback policy, our Board may reduce or cancel, or require recovery of, any incentive-based compensation from current or former executives if the Company has to issue an accounting restatement based on erroneous data due to material non-compliance with any financial reporting requirement under federal securities laws that affect directly or indirectly the objective and subjective metrics used to determine bonuses and restricted stock awards. Broad-Based Employee Benefits

| Broad-Based Employee Benefits |

| · | | The Company’s ESOP Plan is a tax-qualified, defined contribution plan that covers all employees, including the executive officers. Under the ESOP Plan, the Company contributes shares of its Common Stock to the ESOP Plan based on the employees’ total compensation level. |

| · | | All employees, including the executive officers, are eligible to participate on the same basis in all of the Company’s other employee benefit plans which include medical, dental, group life, long term disability, accidental death and dismemberment and eye care insurance. |

| · | | The Company provides no perquisites or other personal benefits to its executive officers. |

| The Company’s ESOP Plan is a tax-qualified, defined contribution plan that covers all employees, including the executive officers. Under the ESOP Plan, the Company contributes shares of Common Stock to the ESOP Plan based on the employees’ total compensation level.

All employees, including the executive officers, are eligible to participate on the same basis in all of the Company’s other employee benefit plans which include medical, dental, group life, long term disability, accidental death and dismemberment and eye care insurance.

The Company provides no perquisites or other personal benefits to its executive officers.

(21)

Change-In-Control Executive Severance Agreements |

The Board believes that the executives’ performance generally may be hampered by distraction, uncertainty and other activities in the event of a change-in-control of the Company which might adversely affect shareholder values. To reduce these potential adverse effects and to encourage fair treatment of the executive officers in connection with any change-in-control event, Change-In-Control Executive Severance Agreements were entered into in 2007 with the executive officers to provide for change-in-control protection. Under these Agreements, if, within two years following a change-in-control event, the Company terminates the employment of any of the executives without cause, or any executive resigns for good reason, that executive would be entitled to a severance payment, payable in a lump sum, in cash, following his termination, in an amount equal to two times the average of the compensation paid to the executive during the two calendar years preceding the change-in-control event (or the annual average of any shorter period). Compensation for this purpose includes the sum of the executive’s base salary, cash bonuses and

contributions made to the ESOP on executive’s behalf. The bonus to beamount used in determining the executive’s compensation shall not be less than two times his targeted bonus for the calendar year in which the change-in-control event occurs (or if not yet determined for that year, two times the executive’s targeted bonus for the preceding calendar year). Further, if the executive qualifies, and the Company is required to provide coverage under COBRA, the Company shall reimburse the executive the costs of purchasing continuing coverage under COBRA for the executive and his dependents for as long as he qualifies for COBRA coverage. The Company ishas not currentlybeen subject to COBRA because it hashad had fewer than 20 employees.employees; however, the Company did reach 20 employees during the latter half of calendar 2012. The Company became subject to COBRA on January 1, 2014. A change-in-control event generally means: (i) the acquisition of beneficial ownership of 30% or more of the Company’s Common Stock; (ii) during any two consecutive years, individuals who currently make up the Company’s Board (or which subsequently become directors after being approved for election by at least a majority of current directors) ceasing for any reason to make up at least two-thirds of the Board; or (iii) approval by the Company’s shareholders of (a) a reorganization, merger or consolidation which results in the ownership of 20% or more of the Company’s Common Stock by persons or entities that were not previously shareholders, (b) a liquidation or dissolution of the Company, or (c) the sale of substantially all of the Company’s assets. There may arise situations where the potential to merge with or be acquired by another company may be in the best interest of our shareholders. Based on this potential, the Company believes that the “double trigger” requiring both (i) a change-in-control event and (ii) the termination of an executive’s employment without cause or his resignation for good reason is appropriate to provide fair treatment of the executive officers, while allowing them to continue to concentrate on enhancing shareholder value during a change-in-control event, as they may take actions which ultimately may lead to their termination after the change-in-control event. Pursuant to the Change-In-Control Executive Severance Agreements, assuming that a change-in-control event took place on the last business day of fiscal 2011,2013, and an executive’s employment was terminated without cause, or the executive terminated his employment for good reason, within two years following this assumed change-in-control event, the executives below would receive the following severance payments: | | | | Name | Salary(1) | Bonus(2) | Total(3) | Michael C. Coffman | $641,000 | $600,000 | $1,241,000 | Paul F. Blanchard, Jr. | $600,000 | $417,000 | $1,017,000 | Lonnie J. Lowry | $419,050 | $109,200 | $528,250 | Ben Spriestersbach | $335,777 | $90,000 | $425,777 | Robb P. Winfield | $329,006 | $87,360 | $416,366 | (1)Calculated based on (i) two times the average of the executive officer’s base salary during calendar years 2011 and 2012 plus (ii) two times the average amount contributed to the ESOP on behalf of each executive for fiscal years 2011 and 2012. (2)Calculated based on two times the maximum targeted bonus for each executive for calendar year 2013. (3)In addition, if the Company is required to provide continuing coverage to its employees under COBRA (as defined in Section 4980B of the Internal Revenue Code of 1986) at the time of a change-in-control, the Company will reimburse each executive for all costs incurred by him in purchasing such continuing coverage for himself and his dependents as long as he qualifies for COBRA coverage. |

(22)

| | | | | | | | | | | | | Name | | Salary(1) | | | Bonus(2) | | | Total(3) | | Michael C. Coffman | | $ | 608,500 | | | $ | 550,000 | | | $ | 1,158,000 | | Paul F. Blanchard, Jr. | | $ | 568,500 | | | $ | 382,500 | | | $ | 951,000 | | Lonni J. Lowry | | $ | 397,843 | | | $ | 103,200 | | | $ | 501,043 | | Ben Spriestersbach | | $ | 314,272 | | | $ | 81,000 | | | $ | 395,272 | | Robb P. Winfield | | $ | 310,673 | | | $ | 80,400 | | | $ | 391,073 | |

(1) | Calculated based on (i) two times the average of the executive officer’s base salary during calendar years 2010 and 2011 plus (ii) two times the average amount contributed to the ESOP on behalf of each executive for fiscal years 2010 and 2011. |

(2) | Calculated based on two times the maximum targeted bonus for each executive for fiscal year 2011. |

(3) | In addition, if the Company is required to provide continuing coverage to its employees under COBRA (as defined in Section 4980B of the Internal Revenue Code of 1986) at the time of a change-in-control, the Company will reimburse each executive for all costs incurred by him in purchasing such continuing coverage for himself and his dependents as long as he qualifies for COBRA coverage. |

Other than the Change-In-Control Executive Severance Agreements, the Company maintains no employment agreements with its executive officers. | Other Compensation Matters |

The Company currently does not have ownership requirements or a stock retention policy for our executive officers. The Company’s Code of Ethics and Business Practices prohibits directors, officers and employees from engaging in speculative transactions involving the Company’s securities. Section 162(m) of the Internal Revenue Code limits the deductibility of compensation in excess of $1,000,000 annually paid to any of our executive officers, unless the compensation qualifies as performance-based compensation. As our compensation levels are well below this level, Section 162(m) is a non-factor for the Company. As of the date of this Proxy Statement, the Company has weathered the ongoing economic conditions in an excellent manner and, to the best of its knowledge, has no upcoming issues. The Company is mindful of the current state of the economy and will continue to evaluate its situation and the potential effects on executive compensation. | Report of the Compensation Committee |

The Compensation Committee has reviewed and discussed the foregoing Compensation Discussion and Analysis with management and, based on such review and discussions, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement. Compensation Committee | Darryl G. Smette—Smette – Chair | Bruce M. Bell

E. Chris Kauffman

Robert O. Lorenz | Robert E. Robotti | H. Grant Swartzwelder |

| (23)

Advisory Vote on Executive Compensation

|

The table below sets forth information for the three most recently completed fiscal years concerning compensation paid to executive officers in those fiscal years for services in all capacities. Summary Compensation Table | Name and Principal Position | Fiscal Year | Base Salary (1) | Cash Bonus (1) | Stock Awards (2) | All Other Compen-sation | Total | Three Year Average | Michael C. Coffman President and Chief Executive Officer | 2013 | $ 297,750 | $303,289(4) | $ 249,602 | $48,167(5) | $ 898,808 | | | 2012 | $ 287,000 | $293,777(4) | $ 269,616 | $44,032(5) | $ 894,425 | | | 2011 | $ 271,250 | $277,119(4) | $ 233,461 | $40,076(5) | $ 821,906 | | | | | | | | | $ 871,713 |

Summary Compensation Table | Name and Principal Position | Fiscal Year | Base Salary (1) | Cash Bonus (1) | Stock Awards (2) | All Other Compen-sation | Total | Three Year Average | Paul F. Blanchard, Jr., Sr. Vice President and Chief Operating Officer | 2013 | $ 276,000 | $218,784(6) | $ 195,709 | $46,317(7) | $ 736,810 | | | 2012 | $ 266,250 | $202,838(6) | $ 211,701 | $43,196(7) | $ 723,985 | | | 2011 | $ 251,250 | $195,866(6) | $ 184,015 | $39,928(7) | $ 671,059 | | | | | | | | $ 710,618 | | | | | | | | | Lonnie J. Lowry, Vice President, Chief Financial Officer and Secretary | 2013 | $ 181,250 | $ 48,392 | $ 17,470 | $35,317(8) | $ 282,429 | | | 2012 | $ 177,250 | $ 46,777 | $ 19,140 | $34,067(8) | $ 277,234 | | | 2011 | $ 169,800 | $ 45,304 | -- | $32,550(8) | $ 247,654 | | | | | | | | $ 269,106 | | | | | | | | | Ben Spriestersbach, Vice President of Land | 2013 | $ 148,750 | $ 41,779 | $ 24,002 | $30,032(9) | $ 244,563 | | | 2012 | $ 142,500 | $ 38,820 | $ 15,491 | $27,779(9) | $ 224,590 | | | 2011 | $ 133,625 | $ 36,104 | -- | $25,743(9) | $ 195.472 | | | | | | | | | $ 221,542 | Robb P. Winfield Controller and Chief Accounting Officer | 2013 | $ 144,350 | $ 40,872 | $ 13,974 | $28,235(10) | $ 227,431 | | | 2012 | $ 138,950 | $ 38,538 | $ 15,022 | $26,822(10) | $ 219,332 | | | 2011 | $ 132,375 | $ 36,170 | -- | $25,341(10) | $ 193,886 | | | | | | | | | $ 213,550 |

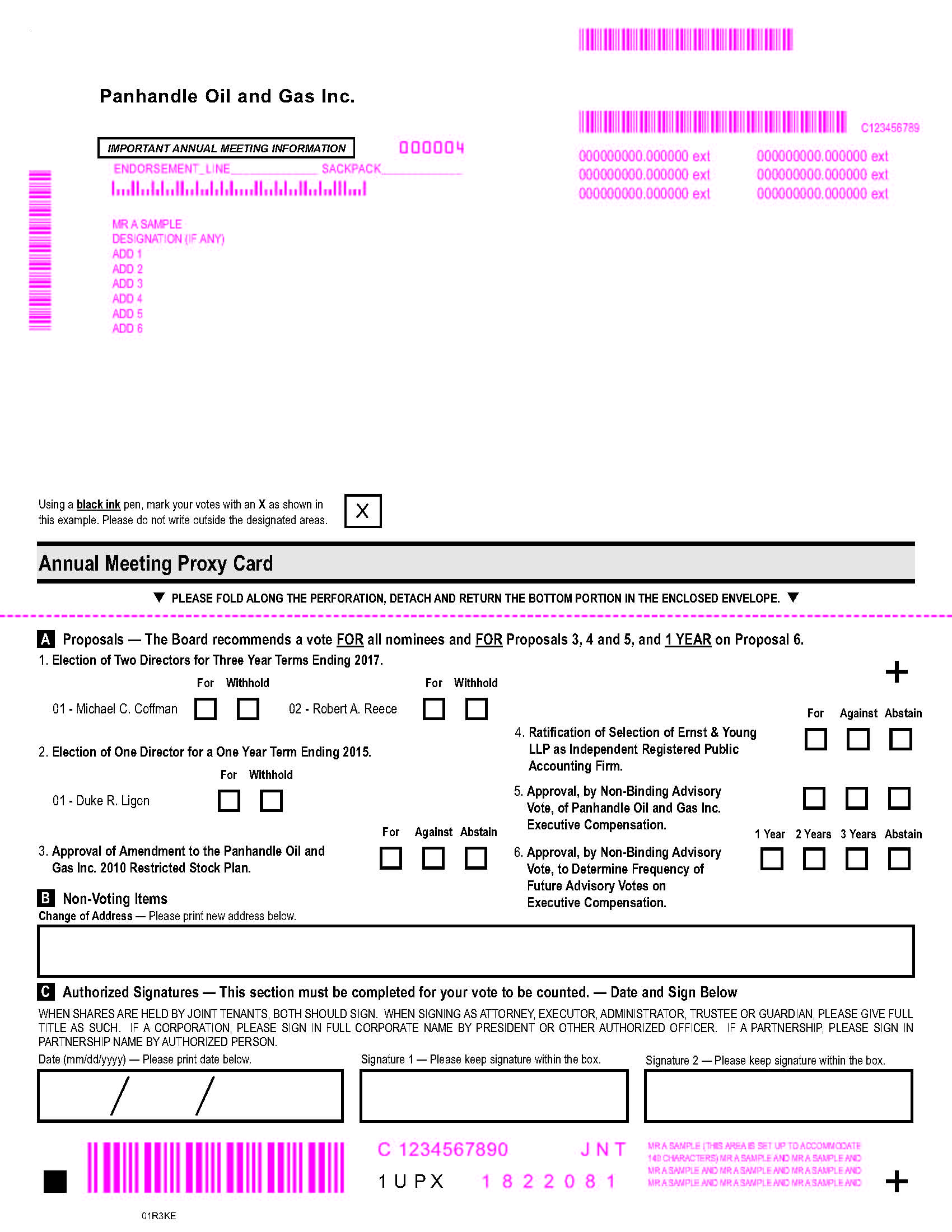

At

| (1) | | Base salaries are set on a calendar year basis and are reported on a fiscal year basis ending on September 30 of each year. This means that the 2011 Annual Shareholders Meeting, shareholders cast advisory votes on approvalsalary shown above for each fiscal year reported represents three months’ salary of the Company’s executive compensation programprevious calendar year and on whether shareholders should vote on executive compensation every three years, two years or one year. More than 93%the first nine months of Shares castthe current calendar year through September 30 fiscal year-end. Cash bonuses are paid in December of each year based on the matter supportedpreceding fiscal year’s performance. Bonuses shown for fiscal 2013 were paid in December 2012 and were based on fiscal 2012 financial and operating performance. The same timing of payments and Company performance holds true for fiscal 2012 and fiscal 2011. |

| (2) | | In accordance with applicable accounting standards, these amounts represent the Company’s executive compensation program. More than 64%aggregate fair value of Shares castthe awards on the matter supported a shareholder vote every three yearsaward date. The ultimate value realized by the executive officers on approvalvesting of the executive compensation program. Basedawards may or may not equal the fair market value at award date based on this vote,failure to achieve the Board has determinedspecified vesting requirements. Under certain circumstances, the awards may wholly or partially vest or never vest. See footnotes (2), (4) and (6) to present the executive compensation programtable entitled “Outstanding Restricted Stock Awards at 2013 Fiscal Year-End” under “Restricted Stock Plan” above in Proposal No.3. |

| (3) | | Includes premiums of immaterial amounts for shareholder approval every three years. The next shareholder vote will occur at the 2014 Annual Shareholders Meeting. Executive Compensation

The table below sets forth informationgroup life insurance for the three most recently completed fiscal years concerning compensation paid to executive officers2013, 2012 and 2011.

|

| (4) | | Included in thoseMr. Coffman’s cash bonuses are performance bonuses (based on each fiscal years for services in all capacities. yearSummary Compensation Table’ | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name and Principal Position | | Fiscal

Year | | | Base

Salary(1) | | | Cash

Bonus(1) | | | Stock

Awards(2) | | | All Other

Compen-

sation(3) | | | Total | | | Three

Year

Average | | Michael C. Coffman, | | | 2011 | | | $ | 271,250 | | | $ | 277,119 | (4) | | $ | 233,461 | | | $ | 40,076 | (5) | | $ | 821,906 | | | | | | President and Chief | | | 2010 | | | $ | 255,000 | | | $ | 111,263 | (4) | | $ | 99,050 | | | $ | 37,769 | (5) | | $ | 503,082 | | | | | | Executive Officer | | | 2009 | | | $ | 236,250 | | | $ | 250,504 | (4) | | | — | | | $ | 35,274 | (5) | | $ | 522,028 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 615,672 | | Paul F. Blanchard, Jr., | | | 2011 | | | $ | 251,250 | | | $ | 195,866 | (6) | | $ | 184,015 | | | $ | 39,928 | (7) | | $ | 671,059 | | | | | | Sr. Vice President and | | | 2010 | | | $ | 235,000 | | | $ | 110,750 | | | $ | 141,500 | | | $ | 37,311 | (7) | | $ | 524,561 | | | | | | Chief Operating | | | 2009 | | | $ | 150,897 | (8) | | | — | | | | — | | | | — | | | $ | 150,897 | | | | | | Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 448,839 | | Lonnie J. Lowry, | | | 2011 | | | $ | 169,800 | | | $ | 45,304 | | | | — | | | $ | 32,550 | (9) | | $ | 247,654 | | | | | | Vice President, Chief | | | 2010 | | | $ | 162,400 | | | $ | 40,110 | | | | — | | | $ | 30,661 | (9) | | $ | 233,171 | | | | | | Financial Officer and | | | 2009 | | | $ | 156,250 | | | $ | 42,075 | | | | — | | | $ | 30,033 | (9) | | $ | 228,358 | | | | | | Secretary | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 236,394 | | Ben Spriestersbach, | | | 2011 | | | $ | 133,625 | | | $ | 36,104 | | | | — | | | $ | 25,743 | (10) | | $ | 195.472 | | | | | | Vice President, of | | | 2010 | | | $ | 128,875 | | | $ | 33,211 | | | | — | | | $ | 24,835 | (10) | | $ | 186,921 | | | | | | Land | | | 2009 | | | $ | 125,750 | | | $ | 34,422 | | | | | | | $ | 24,398 | (10) | | $ | 184,570 | | | | | | | | | | | | | | | | | | | | | — | | | | | | | | | | | $ | 188,988 | | Robb P. Winfield,(11) | | | 2011 | | | $ | 132,375 | | | $ | 36,170 | | | | — | | | $ | 25,341 | (12) | | $ | 193,886 | | | | | | Controller and Chief | | | 2010 | | | $ | 126,875 | | | $ | 32,400 | | | | — | | | $ | 23,987 | (12) | | $ | 183,262 | | | | | | Accounting Officer | | | 2009 | | | $ | 121,667 | | | $ | 32,490 | | | | — | | | $ | 23,196 | (12) | | $ | 177,353 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 184,834 | |

(1) | Salaries are set on a calendar year basis and are reported on a fiscal year basis ending on September 30 of each year. This means that the salary shown above for each fiscal year reported represents three months’ salary of the previous calendar year and the first nine months of the current calendar year. Cash bonuses are paid in December of each year based on the preceding fiscal year’s performance. Bonuses shown for fiscal 2011 were paid in December 2010 and were based on fiscal 2010 financial and operating performance. The same timing of payments and Company performance holds true for fiscal 2009 and fiscal 2008. |

(2) | In accordance with applicable accounting standards, these amounts represent the aggregate fair value of the awards on the grant date. The ultimate value realized by the executive officers on vesting of the awards may or may not equal the fair market value at grant date. See the “Outstanding Restricted Stock Awards at 2011 Fiscal Year-End” table below. |

(3) | Includes premiums of immaterial amounts for group life insurance for fiscal years 2011, 2010 and 2009. |

(24)

(4) | Included in Mr. Coffman’s cash bonuses are performance bonuses (based on each fiscal year’ss financial and operating performance and subjective performance goals) and supplemental payments for the portion of his earned ESOP contribution which could not be made due to the deferral maximum regulations of the Internal Revenue Service. The performance bonuses paid in fiscal years 2011, 2010 and 2009 were $258,180, $72,000 and $225,000, respectively. The supplemental payments in fiscal years 2011, 2010 and 2009 were $18,189, $38,513 and $24,754, respectively. |

(5) | Represents the value of 1,295 shares for fiscal 2011, 1,488 shares for fiscal 2010 and 1,615 shares for fiscal 2009 of Company stock contributed to the ESOP on Mr. Coffman’s behalf based on the closing market price of the shares on the last day of each fiscal year. |

(6) | Included in Mr. Blanchard’s fiscal 2011 cash bonuses is a performance bonus (based on fiscal 2010 financial and operating performance and subjective performance goals) and supplemental payments for the portion of his earned ESOP contribution which could not be made due to the deferral maximum regulations of the Internal Revenue Service. The performance bonus paid in fiscal 2011 was $180,000. The supplemental payment in fiscal 2011 was $15,116. |

(7) | Represents the value of 1,295 shares for fiscal 2011 and 1,488 shares for fiscal 2010 of Company stock contributed to the ESOP on Mr. Blanchard’s behalf based on the closing market price of the shares on the last day of the fiscal year. Because Mr. Blanchard joined the Company January 26, 2009, he received no bonus in fiscal 2009 and was not eligible for an ESOP contribution for fiscal 2009. |

(8) | Since Mr. Blanchard began employment at the Company during January 2009, his fiscal 2009 base salary represents compensation for approximately eight months. |

(9) | Represents the value of 1,137 shares for fiscal 2011, 1,230 shares for fiscal 2010 and 1,392 shares for fiscal 2009 of Company stock contributed to the ESOP on Mr. Lowry’s behalf based on the closing market price of the shares on the last day of each fiscal year. |

(10) | Represents the value of 897 shares for fiscal 2011, 984 shares for fiscal 2010 and 1,124 shares for fiscal 2009 of Company stock contributed to the ESOP on Mr. Spriestersbach’s behalf based on the closing market price of the shares on the last day of each fiscal year. |

(11) | Mr. Winfield was named an executive officer effective March 5, 2009. |

(12) | Represents the value of 891 shares for fiscal 2011, 967 shares for fiscal 2010 and 1,082 shares for fiscal 2009 of Company stock contributed to the ESOP on Mr. Winfield’s behalf based on the closing market price of the shares on the last day of the fiscal year. |

The Company’s only equity incentive plans for its executive officers are the ESOP Plan and the 2010 Restricted Stock Plan described below.

ESOP Plan

The ESOP Plan is a tax-qualified, defined contribution plan, and serves as the Company’s only retirement plan for its employees. Contributions are made at the discretion of the Board and, to date, all contributions have been made in shares of Common Stock. Contributions are allocated to all participants in proportion to their compensation for the plan year and 100% vesting occurs after three years of service. Separation prior to three years of service results in forfeiture of all contributions received. All employees, including the executive officers, may participate in the 401(k) portion of the ESOP Plan on a voluntary basis. Under the terms of the 401(k) portion of the ESOP Plan, eligible employees may elect to defer a portion of their earnings up to the maximum allowed by regulations of the Internal Revenue Service. The performance bonuses paid in fiscal years 2013, 2012 and 2011 were $259,339, $250,250 and $258,180, respectively. The supplemental payments in fiscal years 2013, 2012 and 2011 were $43,200, $42,777 and $18,189, respectively.

|

| (5) | | Represents the value of 1,326 shares for fiscal 2013, 1,222 shares for fiscal 2012 and 1,295 shares for fiscal 2011, of Company makes no matching contributionsstock contributed to the 401(k) portion ofESOP on Mr. Coffman’s behalf based on the ESOP Plan. 2010 Restricted Stock Plan

Awards. The 2010 Restricted Stock Plan permits the grant of shares of restricted stock to Company officers and is used by the Compensation Committee for long-term incentive compensation. The Company will sell shares of restricted stock to officers at a significant discount to the fairclosing market valueprice of the shares generally aton the parlast day of each fiscal year and dividends received from restricted stock awards of $9,893, $6,248 and $3,042 for fiscal years 2013, 2012 and 2011, respectively.

|

| (6) | | Included in Mr. Blanchard’s cash bonuses are performance bonuses (based on each fiscal year’s financial and operating performance and subjective performance goals) and supplemental payments for the portion of his earned ESOP contribution which could not be made due to the deferral maximum regulations of the Internal Revenue Service. The performance bonuses paid in fiscal years 2013, 2012 and 2011 were $189,378, $174,038 and $180,000, respectively. The supplemental payments in fiscal years 2013, 2012 and 2011 were $28,656, $28,050 and $15,116, respectively. |

| (7) | | Represents the value of 1,326 shares for fiscal 2013, 1,222 shares for fiscal 2012 and 1,295 shares for fiscal 2011 of Company stock contributed to the ESOP on Mr. Blanchard’s behalf based on the closing market price of the shares on the last day of each fiscal year and dividends received from restricted stock awards of $8,403, $5,544 and $3,026 for fiscal years 2013, 2012 and 2011, respectively. |

| (8) | | Represents the value of 1,218 shares for fiscal 2013, 1,095 shares for fiscal 2012 and 1,137 shares for fiscal 2011 of Company stock contributed to the ESOP on Mr. Lowry’s behalf based on the closing market price of the shares on the last day of each fiscal year and dividends received from restricted stock awards of $435 and $179 for fiscal years 2013 and 2012, respectively. |

| (9) | | Represents the value of 1,010 shares for fiscal 2013, 886 shares for fiscal 2012 and 897 shares for fiscal 2011 of Company stock contributed to the ESOP on Mr. Spriestersbach’s behalf based on the closing market price of the shares on the last day of each fiscal year and dividends received from restricted stock awards of $463 and $145 for fiscal years 2013 and 2012, respectively. |

(10)Represents the value of 982 shares for fiscal 2013, 868 shares for fiscal 2012 and 891 shares for fiscal 2011, of Company stock contributed to the ESOP on Mr. Winfield’s behalf based on the closing market price of the shares on the last day of each fiscal year and dividends received from restricted stock awards of $344 and $140 for fiscal years 2013 and 2012, respectively. The Company’s only equity incentive plans for its executive officers are the ESOP Plan discussed below and the Restricted Stock Plan described above in Proposal No. 3. The ESOP Plan is a tax-qualified, defined contribution plan, and serves as the Company’s only retirement plan for its employees. Contributions are made at the discretion of the Board and, to date, all contributions have been made in shares of Common Stock. Contributions are allocated to all participants in proportion to their compensation for the plan year and 100% vesting occurs after three years of service. Separation prior to three years of service results in forfeiture of all contributions received. All employees, including the executive officers, may participate in the 401(k) portion of the ESOP Plan on a voluntary basis. Under the terms of the 401(k) portion of the ESOP Plan, eligible employees may elect to defer a portion of their earnings up to the maximum allowed by regulations of the Internal Revenue Service. The Company makes no matching contributions to the 401(k) portion of the ESOP Plan. | Proposal No. 6

Advisory Vote to Determine Frequency of Future Advisory

Votes on Executive Compensation |

At the 2011 Annual Meeting of Shareholders, the Board recommended and the shareholders approved that the shareholder advisory vote on executive compensation should occur every three years. The Board has subsequently determined that a vote every year on executive compensation is a better and more accepted approach and is consistent with current thought on good corporate governance practices. In recognition of the above, the Board urges shareholders to approve an advisory vote on executive compensation every year. Although the vote is non-binding, our Board of Directors will take into account the outcome of the vote when making future decisions about the Company’s executive compensation policies and procedures. The Company’s shareholders also have the opportunity to provide additional feedback on important other matters involving executive compensation. For example, the rules of the New York Stock Exchange require the Company to seek shareholder approval for new employee equity compensation plans and material revisions thereto. This is the reason the Company is seeking shareholder approval of the amendment to the 2010 Restricted Stock Plan set forth in Proposal 3. As discussed below under “Communications with the Board of Directors”, the Company provides shareholders an opportunity to communicate directly with the Board, including issues abut executive compensation. Because the vote is advisory, it will not be binding upon the Board or the Compensation Committee and neither the Board nor the Compensation Committee will be required to take any action as a result of the outcome of the vote on this proposal. The Compensation Committee will

carefully consider the outcome of the vote when considering future executive compensation arrangements. The Board of Directors Recommends a Vote

“FOR”

an Advisory Vote on Executive Compensation Every Year | Stock Ownership of Certain Beneficial Owners |

Based on filings with the Securities and Exchange Commission (“SEC”), we know that the following shareholders are beneficial owners of more than 5% of our outstanding shares of Common Stock as of December 31, 2013. Robert E. Robotti, a director of the Company, also owns beneficially more than 5% of our Common Stock which ownership is set forth above in “Stock Ownership of Directors and Executive Officers” on page 7. Name and Address of Beneficial Owner | Amount of Shares Beneficially Owned | Percent of Common Stock | BlackRock, Inc.

40 E. 52nd Street

New York, NY 10022 | 431,767(1) | 5.2% | Amica Mutual Insurance Company

100 Amica Way

Lincoln, RI 02965 | 550,492(2) | 6.7% |

(1)Based on a Schedule 13G filed with the SEC in February 2013. (2)Based on a Schedule 13G filed with the SEC in February 2013. | Section 16(a) Beneficial Ownership Reporting Compliance |

Section 16(a) of the Securities and Exchange Act of 1934 requires the Company’s directors and executive officers and persons who own more than ten percent of the Company’s Common Stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of the Common Stock, and to furnish the Company with copies of such reports. Based on a review of the filings with the Securities and Exchange Commission and representations that no other reports were filed, the Company believes that during fiscal 2013 all directors and executive officers complied with the reporting requirements of Section 16(a), with the exception of Duke R. Ligon who filed a late report on September 9, 2013 relating to 514 shares purchased on June 13, 2013, and Darryl G. Smette who filed a late report on September 9, 2013 relating to 4 shares purchased on June 13, 2013. These purchases were made through a dividend reinvestment program conducted by the broker holding their shares. | Communications with the Board of Directors |

The Company provides an informal process for shareholders and other interested parties to send communications to its Board. Shareholders or other interested parties who wish to contact the Lead Independent Director, the outside directors as a group, or any of its individual members may do so by writing: Board of Directors, Panhandle Oil and Gas Inc., 5400 N. Grand Boulevard, Suite 300, Oklahoma City, OK 73112-5688. Correspondence directed to any individual Board

member is referred, unopened, to that member. Correspondence not directed to a particular Board member is referred, unopened, to the Lead Independent Director. Proposals of shareholders intended to be presented at the next annual shareholders meeting to be held in March 2015, and to be included in the proxy statement and form of proxy pursuant to Rule 14a-8 under the Securities and Exchange Act of 1934, must be received by the Company by October 1, 2014. Any such proposals should be in writing and be sent by certified mail, return receipt requested, to the Company’s office at the address shown below under the caption “Form 10‑K”, Attention: Secretary. On receipt of any such proposal, the Company will determine whether or not to include such proposal in the proxy statement and any proxy card in accordance with regulations governing the solicitation of proxies. Under the Company’s Bylaws, in order for a shareholder to nominate a candidate for director, or propose other business to be considered by shareholders, timely notice of the nomination or the other business proposed must be received by the Company in advance of the annual meeting. Ordinarily, such notice must be received not less than 90 nor more than 120 days prior to the first anniversary of the mailing of notice for the preceding year’s annual shareholders meeting. The shareholder filing the notice of nomination must describe various matters regarding the nominee, including, but not limited to, such information as name, address, occupation, business background and shares held, and the nominee must deliver a written questionnaire and agreement to the Company covering certain matters as specified in the Bylaws. In order for a shareholder to bring other business before a shareholders’ meeting, timely notice must be received by the Company within the time limits described above in this paragraph for notice of nomination of a candidate for director. Such notice must include a description of the proposed business, the reasons therefor, and other specified matters. These requirements are separate from the requirements a shareholder must meet to have a proposal included in the Company’s proxy statement under Rule 14a-8 of the Securities and Exchange Act of 1934. In each case, the notice must be given to the Secretary of the Company at the address shown below under the caption “Form 10-K”. Any shareholder desiring a copy of the Company’s Bylaws will be furnished one without charge on written request to the Secretary. A copy of the Bylaws is available on the Company’s website at www.panhandleoilandgas.com. The Company’s Bylaws were amended on December 11, 2013 to provide access to the Company’s proxy statement and proxy card for director elections to eligible shareholders who wish to nominate a person for election to the Company’s Board of Directors. To be eligible to access the Company’s proxy statement and proxy card for this purpose, a shareholder, together with its affiliates, must have held beneficial ownership of 5% of the Company’s common stock for at least one year prior to providing notice to the Company seeking access to its proxy statement. Notice from a shareholder seeking such access must be received by the Company in the same time period required for shareholders seeking to nominate directors to the Company’s Board of Directors. Only one seat on the Board may be held by a person elected as a director resulting from a shareholders use of these proxy access Bylaw provisions. A shareholder seeking access to the Company’s proxy statement shall provide all information required from a shareholder seeking to nominate a director as well as undertakings signed by the shareholder and the proposed nominee. The Bylaw provision

is the exclusive means for shareholders to include nominees for a director in the Company proxy statement and proxy card. A shareholder seeking access to the Company’s proxy statement shall provide all information required from a shareholder seeking to nominate a director as well as undertaking signed by the shareholder and the proposed nominee. This Bylaw provision is the exclusive means for shareholders to include nominees for director in the Company’s proxy statement and proxy card. | Annual Report to Shareholders |

Copies of the Annual Report to Shareholders for fiscal 2013 are being mailed with this proxy statement and a copy of the Annual Report is available on the Company’s website at: www.panhandleoilandgas.com. A copy of the Company’s Annual Report on Form 10-K for fiscal 2013 filed with the Securities and Exchange Commission is included in the Annual Report to Shareholders mailed with this proxy statement. A separate Form 10-K and copies of the Company’s charters for the various committees of the Board, the Corporate Governance Guidelines and the Company’s codes of ethics are available, free of charge, on written or oral request made to the Company at the address or telephone number set forth below, or can be viewed at the Company’s website: www.panhandleoilandgas.com. Lonnie J. Lowry, Secretary Panhandle Oil and Gas Inc. 5400 N. Grand Boulevard, Suite 300 Oklahoma City, OK 73112-5688 405.948.1560

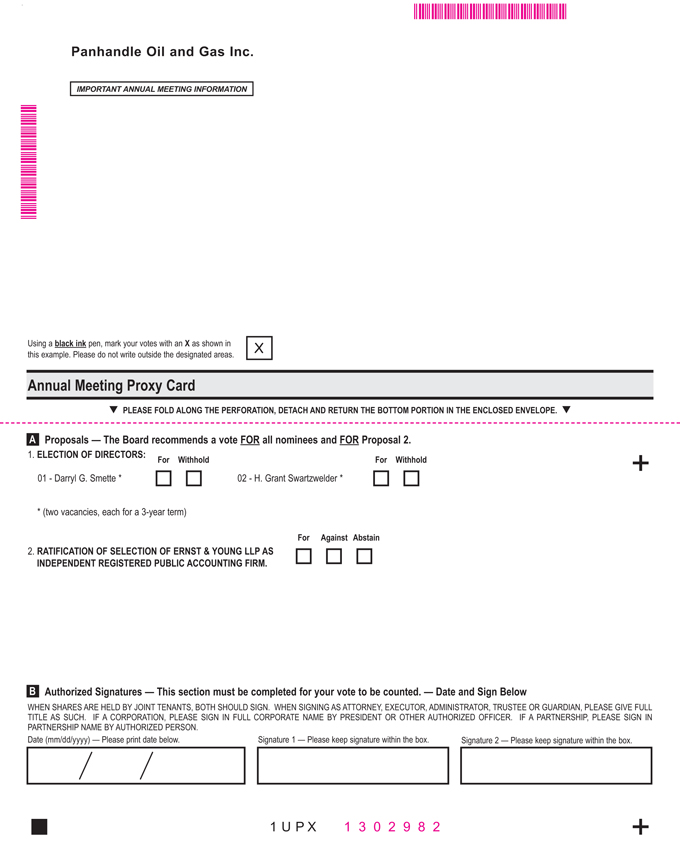

Management knows of no other matters to be brought before the meeting. However, if any other matters do properly come before the meeting, it is intended that the shares represented by the proxies in the accompanying form will be voted as the Board may recommend. Whether shareholders plan to attend the meeting or not, they are respectfully urged to mark, sign, date and return the enclosed proxy, which will be returned to them at the meeting if they are present and so request. By Order of the Board of Directors January 28, 2014Lonnie J. Lowry, Secretary Whether Or Not You Expect To Attend The Annual Meeting, Please Mark, Sign And Date The Enclosed Proxy And Mail It Promptly In The Postage-Paid Envelope Provided. If Your Shares Are Held By A Broker Or Other Nominee, Please Provide Specific Voting Instructions To The Broker Or Nominee So Your Shares Can Be Voted at the Annual Meeting.

(THIS PAGE INTENTIONALLY LEFT BLANK)

APPENDIX A

PANHANDLE OIL AND GAS INC. AMENDED 2010 RESTRICTED STOCK PLAN March 5, 2014

TABLE OF CONTENTS | | | | Section 1. Introduction | | 3 | | 1.1.Purpose of the Plan | | 3 | | 1.2.Nature of Sales of Restricted Stock | | 3 | | 1.3.Effective Date and Term of Plan | | 3 | Section 2. Definitions And Construction | | 3 | | 2.1.Definitions | | 3 | | 2.2.Construction | | 4 | Section 3. Eligibility | | 4 | | 3.1.In General | | 4 | Section 4. Administration Of The restricted sharesPlan | | 4 | | 4.1.In General | | 4 | Section 5. Shares Subject To The Plan | | 5 | | 5.1.Number of Shares | | 5 | Section 6. Restricted Stock | | 5 | | 6.1.Sale of Restricted Stock | | 5 | | 6.2.The Restricted Period | | 5 | | 6.3.Escrow | | 5 | | 6.4.Dividends | | 6 | | 6.5.Repurchase of Restricted Stock | | 6 | | 6.6.Expiration of Restricted Period | | 6 | | 6.7.Rights as a Shareholder | | 6 | Section 7. Adjustments | | 6 | | 7.1.Changes in Capitalization | | 6 | Section 8. Change In Control | | 6 | | 8.1.Consequences of a Change In Control on Restricted Stock | | 6 | | 8.2.Change In Control Defined | | 7 | Section 9. General Provisions | | 7 | | 9.1.Transferability of Restricted Stock | | 7 | | 9.2.Termination of Status | | 7 | | 9.3.Withholding | | 7 | | 9.4.Other Conditions on Delivery of Stock | | 8 | Section 10. Miscellaneous | | 8 | | 10.1.No Right to Continued Employment | | 8 | | 10.2.Amendment | | 8 | | 10.3.Compliance with Code Section 409A | | 8 | | 10.4.Governing Law | | 8 | | | | | | | | |

PANHANDLE OIL AND GAS INC. AMENDED 2010 RESTRICTED STOCK PLAN

| 1.1.Purpose of the Plan.The Plan provides an essential long-term component to the Company’s total compensation package for its officers and directors reflecting the importance the Company places on aligning the interest of its officers and directors with those of its shareholders and provides incentives for officers and directors to remain with the Company.The Plan will vest afterenhance the Company’s ability to attract, retain and motivate officers and directors of the Company. | 1.2.Nature of Sales of Restricted Stock.The Plan is intended to permit the Sale by the Company of Shares of Restricted Stock to its officers and directors subject to various vesting based on the passage of time (typically over several yearsor other conditions to vesting and other restrictions on the anniversary datestransferability of the issuance of the restricted stock) and vesting may alsoShares sold. The transfer restrictions on these Shares will be subject to the market price performance of the Company’s Common Stock. The minimum vesting period is two years but is expected to be three to five years. The Company will repurchase the restricted stock at the original purchase price if vesting does not occur. (25)

Officers participate in this programremoved based on their (i) ability to make a significant contribution to the Company’s financial and operating results, (ii) level of responsibility, and (iii) performance. No officer is entitled to participate automatically based on title, position or salary level. This program is designed to help retain key officers ofvesting restrictions contained in the Stock Restriction Agreement between the Company and participation willthe affected Participant. Except as otherwise provided by the Plan, each Sale hereunder may be highly selective.

Each participantmade alone or in the 2010 Restricted Stock Plan enters into a stock restriction agreement with the Company setting forth theaddition or in relation to any other Sale. The terms conditionsof each Sale need not be identical, and restrictions of the restricted stock grant. The restricted stock is issued in the name of the participant and deposited with the Company, or an escrow agent determined by the Compensation Committee until the restrictions lapse or until vesting is no longer possible under the stock restriction agreement.

Subject to the terms and conditions of the stock restriction agreement, a participant holding restricted stock has the right to receive dividends on the shares of restricted stock during the restriction period, vote the restricted stock and enjoy other shareholder rights related to the restricted stock. On expiration of the restriction period, subject to the terms of the Plan and the stock restriction agreement, the participant will be entitled to receive shares of Common Stockneed not subject to restriction.treat Participants uniformly.

| 1.3.Effective Date and Term of Plan. The 2010 Restricted StockIf approved by shareholders at the Company’s 2014 Annual Shareholders Meeting, the Plan waswill be effective onas of March 11, 2010.5, 2014. No restricted stock cansales to Participants shall be awardedpermitted under the Plan after the day before the tenth anniversary of the effective date,March 5, 2024 but the vesting periods for restricted stockShares previously sold may extend beyond that date. |

| Section 2. Definitions And Construction |

| | | 2.1.Definitions. When used in this Plan, the following terms shall have the meanings set forth below, unless the context clearly requires a different meaning: | (a) | “Board” means the Board of Directors of the Company. | (b) | “Change in Control”shall have the meaning set forth in Section 8.2. | (c) | “Code”means the Internal Revenue Code of 1986, as amended. | (d) | “Common Stock” means the Company’s Class A Common Stock, par value $0.01666 per share. | (e) | “Company”means Panhandle Oil and Gas Inc. | (f) | “Compensation Committee”shall mean the Compensation Committee of the Board. | (g) | “Disability” shall mean incapacity due to physical or mental illness as determined by the Compensation Committee. | (h) | “Effective Date”means the first date set forth in Section 1.3. |

(i) | “Fair Market Value” means the closing sales price (for the primary trading session) of a Share on the date the Restricted Period ends. For any date that is not a trading day, the Fair Market Value of a Share for such date will be determined by using the closing sales price for the immediately preceding trading day. | (j) | “Participant” means any officer or director who purchases Restricted Stock. | (k) | “Plan”means this Amended 2010 Restricted Stock Plan. | (l) | “Repurchase” shall have the meaning as set forth in Section 6.5. | (m) | “Restricted Period”means the period of time during which the transfer of the Shares of Restricted Stock shall be restricted and after which the shares of Restricted Stock shall be vested. | | (n) | “Restricted Stock”means Shares sold under this Plan. | | (o) | “Sale”means a sale of shares of Restricted Stock made under the Plan. | | (p) | “Share” means a share of Class A Common Stock, par value $0.01666 per share, of the Company. | | (q) | “Stock Restriction Agreement”means all agreements between the Company and a Participant covering the Sale of Restricted Stock under this Plan. | 2.2.Construction. When used in the Plan, (a) the terms “include” and “including” shall be deemed to include the phrase “but not limited to” and (b) masculine pronouns shall include the feminine. |

| 3.1.In General.Any natural person is eligible to purchase Restricted Stock if such individual is a current officer or director of the Company or any of the Company’s present or future subsidiary entities in which the Company has a controlling interest, as determined by the Compensation Committee, are eligible toCommittee. |

| Section 4. Administration Of The Plan |

| | | 4.1.In General. | | (a) | The Plan will be granted an award of restricted stock. Administration. The 2010 Restricted Stock Plan is administered by the Compensation Committee of the Board, which has authority to grant awards of restricted stock and determine recipients and the terms of awards.Committee. The Compensation Committee hasshall have authority to determine the Participants and terms and conditions of any Sale of Restricted Stock, and to adopt, amend and repeal such administrative rules, guidelines and practices relating to the Plan as it shall deem advisable.

| | (b) | The Compensation Committee shall have full discretionary authority to construe and interpret the terms of the 2010 RestrictedPlan and any Stock PlanRestriction Agreement, and to determine all facts necessary to administer the Plan.Plan and any Stock Restriction Agreement. The Compensation Committee may correct any defect, supply any omission or reconcile any inconsistency in the Plan or any Stock Restriction Agreement in the manner and to the extent it shall deem necessary or advisable. |

| (c) | All decisions by the Compensation Committee shall be made in its sole discretion and shall be final and binding on all persons having or claiming any interest in the Plan or in any purchase of Restricted Stock. No director or person acting pursuant to the authority delegated by the Compensation Committee shall be liable for any action or determination relating to or under the Plan made in good faith. |

| Section 5. Shares Subject To The Plan |

| | | Stock 5.1.Number of Shares.

| | (a) | Subject to the 2010adjustment under Section 7.1, Sales of Restricted Stock Plan. Subject to adjustments allowed under the 2010 Restricted Stock Plan, awards of restricted stock may be made under the Plan for up to 100,000 shares250,000 Shares. | | (b) | If Shares sold hereunder are repurchased by the Company prior to the vesting of Common Stock. If any award of restricted stock expires or is terminated, surrendered or canceled without being fully vested,such Shares the unused shares covered by such award willrepurchased Shares shall again be available for grantssale by the Company to officers under the Plan. Shares issued under the Plan may consist in whole or in part of authorized but unissued shares or treasury shares. |

| Section 6. Restricted Stock |

| 6.1.Sale of Restricted Stock. PursuantThe Compensation Committee may sell Shares of Restricted Stock to such officers and directors as it determines. The sales price of Shares shall be at a significant discount to the Fair Market Value of the Shares, generally at a per Share price equal to the par value of the Shares sold. Sales of Restricted Stock shall be subject to such restrictions on transfer and the Repurchase of Restricted Stock by the Company and such other terms and conditions, subject to the provisions of the Plan, as determined by the Compensation Committee. | 6.2.Restricted Period.At the time a Sale of Restricted Stock is made to a Participant, the Compensation Committee shall establish a period of time during which the transfer of the Shares of Restricted Stock shall be restricted and after which the Shares of Restricted Stock shall be vested (the “Restricted Period”). Each Sale of Restricted Stock may grant awardshave a different Restricted Period. The Compensation Committee shall determine the Restricted Period for all Restricted Stock. | 6.3.Escrow.Each Participant purchasing Restricted Stock shall enter into a Stock Restriction Agreement with the Company setting forth the terms, conditions and restrictions of restrictedthe Sale. Any certificates representing Shares of Restricted Stock shall be registered in the name of the Participant and deposited with the Company, or an escrow agent as determined by the Compensation Committee, together with a stock onpower for each certificate endorsed in blank by the Participant. Each such certificate shall bear a legend in substantially the following form: The transferability of this certificate and the shares of Common Stock represented by it are subject to the terms and conditions set forthcontained in the Panhandle Oil and Gas Inc. 2010 Restricted Stock Plan (the “Plan”), and an agreement entered into between the registered owner and Panhandle Oil and Gas Inc. Copies of the Plan and the agreement are on file at the principal office of Panhandle Oil and Gas Inc. Alternatively, in the discretion of the Company, ownership of the Shares of Restricted Stock and the appropriate restrictions shall be reflected in the records of the Company’s transfer agent and no physical stock certificates shall be issued prior to vesting. |

6.4.Dividends. Unless otherwise determined by the Compensation Committee or provided in the Stock Restriction Agreement, Participants holding Restricted Stock will be eligible to receive all dividends paid with respect to such Shares. If any dividends or distributions are paid in Shares, or consist of a dividend or distribution to holders of Shares other than an ordinary cash dividend, the Shares or other property will be subject to the same restrictions on transferability as the Restricted Stock with respect to which they were paid and such Shares or other property shall be deposited with the Company or in escrow as provided in Section 6.3. | 6.5.Repurchase of Restricted Stock.In the event any Shares of Restricted Stock under the terms of the Stock Restriction Agreement (including any additional shares of Restricted Stock that may result from changes in capitalization of the Company as provided in Section 7.1) do not vest, the Company shall repurchase (“Repurchase”) such Shares from the affected Participant for a price equal to the original sale price. All repurchased Shares shall be surrendered to the Company and the stock certificates representing such Shares shall be cancelled. | 6.6.Expiration of Restricted Period. Upon the expiration of the Restricted Period and the satisfaction of any other conditions prescribed by the Compensation Committee or set forth in the Stock Restriction Agreement, the restrictions applicable to the Restricted Stock shall lapse and, unless otherwise instructed by the Participant, a stock restriction agreement,certificate for the number of Shares of Restricted Stock with respect to which the restrictions have lapsed shall be released by the Company or from escrow and delivered, free of all such restrictions and legends, except any that may be imposed by law, to the Participant or the Participant’s estate, as the case may be. | 6.7.Rights as a Shareholder.Subject to the terms and conditions of the Plan, each Participant receiving Restricted Stock shall have all the rights of a shareholder with respect to the Shares of Restricted Stock during the Restricted Period, including the conditions for vesting,right to vote any shares of Restricted Stock and to receive payment of dividends subject to the vesting periods, the issue price and the acceleration of vestingprovisions in certain events. The vesting period for any restricted stock award will be a minimum of two years.Section 6.4. |

| Section 7. Adjustments Due to |

| 7.1.Changes in Capitalization or Control. In the event of any stock split, reverse stock split, stock dividend, recapitalization, combination of shares, reclassification of shares, spin-off or other similar change in capitalization or event, or any dividend or distribution to holders of shares of Common StockShares other than an ordinary cash dividend, (i)(a) the number and class of securities available under this Plan, (b) the number of shares of Common Stock availableShares sold under this Plan and (c) the 2010 Restricted Stock Plan, (ii)price payable to a Participant upon the number of shares of Common Stock subject (26)

to and the repurchase price per share subject to each outstanding restricted stock award, and (iii) the terms of each other outstanding awardRepurchase, shall be equitably adjusted by the Company in the manner determined by the Compensation Committee.

|

| Section 8. Change inIn Control |

8.1.Consequences of a Change In Control on Restricted Stock.Upon the occurrence of a Change In Control, except to the extent specifically provided to the contrary in the applicable Stock Restriction Agreement, all restrictions and conditions on all Restricted Stock then outstanding shall automatically lapse and be deemed terminated or satisfied, as applicable.

8.2.Change In Control Defined. On For purposes of this Plan, “Change In Control” shall mean the occurrence of any one or more of the following: | | (i) | any “person” (as such term is used in Section 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) (other than a changetrustee or other fiduciary holding securities under an employee benefit plan of the Company) is or becomes the “beneficial owner” (as defined in controlRule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company as definedrepresenting 30% or more of the total voting power represented by the Company’s then outstanding Voting Securities; or | | (ii) | during any period of two consecutive years, individuals who at the beginning of such period constitute the Board of Directors of the Company (the “Incumbent Board”), and any new director, whose election by the Board or nomination by the Board for election by the Company’s shareholders was approved by a vote of at least two-thirds (⅔) of the directors then still in office who either were directors at the beginning of the period or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority of the Board, or | | (iii) | the shareholders of the Company approve a merger or consolidation of the Company with any other corporation, other than a merger or consolidation that would result in the Plan, exceptVoting Securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into Voting Securities of the extent provided tosurviving entity) at least 80% of the contrarytotal voting power represented by the Voting Securities of the Company or such surviving entity outstanding immediately after such merger or consolidation; or | | (iv) | the shareholders of the Company approve a plan of complete liquidation of the Company or an agreement for the sale or disposition by the Company (in one transaction or a series of transactions) of all or substantially all of the Company’s assets. | As used in this Section 8.2, the term “Voting Securities” means the Company’s Class A Common Stock, par value $0.01666 per share, and any other securities of the Company that vote generally in the stock restriction agreement between a participant and the Company, all restrictions and conditions on all restricted stock awards then outstanding shall automatically lapse and be deemed terminated or satisfied, as applicable.election of directors. |

| Section 9. General Provisions |

| 9.1.Transferability of AwardsRestricted Stock. Unless otherwise provided byExcept as the Compensation Committee restricted stock willmay otherwise determine or provide in a Stock Restriction Agreement, Restricted Stock may not be nontransferable,sold, assigned, transferred, pledged or otherwise encumbered by Participants holding Restricted Stock, either voluntarily or by operation of law, except by will or the laws of descent and distribution or, pursuant to a qualified domestic relations order. References herein to a Participant, to the extent relevant in the context, shall include references to authorized transferees. | Voting and Dividends. Holders of shares of restricted stock may vote their shares. Dividends are paid on restricted stock.9.2.

Termination of EmploymentStatus.The Compensation Committee willshall determine the effect on restricted stock due toRestricted Stock of the disability,Disability, death, early or normal retirement, termination or other cessation of employment, authorized leave of absence or other change in the employment of a participant.Participant. |

Tax 9.3.Withholding. A participant in the 2010 Restricted Stock PlanThe Participant must satisfy all applicable federal, state, and local or other income and employment tax withholding obligations before the Company will authorize the Shares to be released from escrow to the Participant. The Company may decide to satisfy the withholding obligations through additional withholding on salary or wages. If the Company elects not to or cannot withhold from other compensation, the Participant must pay the Company the full amount, if any, required for withholding. Payment of withholding obligations is due before the Company will authorize the release of the Shares. Ifapproved by the Compensation Committee, a Participant may satisfy such tax obligations in whole or in part by delivery of a portion of the Restricted Stock creating the tax obligation, valued at Fair Market Value; provided, however, except as otherwise provided by the Compensation Committee, that the total tax withholding where Restricted Stock is being used to satisfy such tax obligations cannot exceed the Company’s minimum statutory withholding obligations (based on minimum statutory withholding rates for federal and state tax purposes, including payroll taxes, that are applicable to such supplemental taxable income). Shares surrendered to satisfy tax withholding requirements cannot be subject to any repurchase, forfeiture, unfulfilled vesting or other similar requirements.

| 9.4.Other Conditions on Delivery of Stock. The Company will not be obligated to remove restrictions from Shares previously delivered under the Plan until (a) all conditions of the Sale have been met or removed to the satisfaction of the Company, before it will authorize(b) in the restrictedopinion of the Company’s counsel, all other legal matters in connection with the delivery of such Shares have been satisfied, including any applicable securities laws and any applicable stock exchange or stock market rules and regulations, and (c) the Participant has executed and delivered to be released by the Company such representations or from escrow. The Compensation Committeeagreements as the Company may allow a participantconsider appropriate to satisfy allthe requirements of any applicable laws, rules or partregulations. |

Section 10. Miscellaneous | 10.1.No Right to Continued Employment. No Participant under the Plan who is an officer of these withholding obligations by transferring sharesthe Company shall have any right, because of restricted stockhis or her participation, to continue in the Company.employment of the Company for any period of time or to any right to continue his or her present or any other rate of compensation. | 10.2.Amendment of Awards. The Compensation Committee may amend, suspend or terminate the 2010 Restricted Stock Plan or any portion of the Plan at any time; provided that if at any time the approval of the Company’s shareholders is required as tofor any modification or amendment under applicable laws and rules, the Compensation Committee may not effect such modification or amendment without shareholdersuch approval. Unless otherwise specified in the amendment, any amendment to the 2010 Restricted Stock Plan adopted in accordance with this Section 10.2 shall apply to, and be binding on, the holders of restricted stockall Shares of Restricted Stock outstanding under the Plan at the time the amendment is adopted, provided the Compensation Committee determines that such amendment, taking into account any related action, does not materially and adversely affect the rights of participantsexisting Participants under the Plan. | Outstanding Equity Awards at Fiscal Year-End. The following table provides information on the holdings10.3.Compliance with Code Section 409A. No Sale of restricted stock by our executive officers at the end of fiscal 2011. No shares of restricted stock are vested.

(27)

OUTSTANDINGRESTRICTEDSTOCKAWARDSAT 2011FISCALYEAR-END

| | | | | | | | | | | | | | | | | | | Grant Date | | | Approval Date | | | Number of Shares of

Restricted Stock That

Have Not Vested | | | Market Value of Shares

of Restricted Stock That

Have Not Vested(5) | | Michael C. Coffman

| |

| June 18, 2010

December 21, 2010 |

| |

| May 19, 2010

December 21, 2010 |

| |

| 3,500

9,821

| (1)(2)

(3)(4)

| | $

$ | 99,295

278,622 |

| | | | | | Paul F. Blanchard, Jr.

| |

| June 18, 2010

December 21, 2010 |

| |

| May 19, 2010

December 21, 2010 |

| |

| 5,000

7,741

| (1)(2)

(3)(4)

| | $

$ | 141,850

219,612 |

|

(1) | Mr. Coffman and Mr. Blanchard paid $0.01666 per share, or $58.31 and $83.30, respectively, to purchase their restricted stock. |

(2) | Consists of the restricted stock awards granted on June 18, 2010 which vest on the completion of five years of service, commonly known as “cliff vesting”. |

(3) | Mr. Coffman and Mr. Blanchard paid $0.01666 per share, or $163.62 and $128.97, respectively, to purchase their restricted stock. |

(4) | Consists of the restricted stock awards granted on December 21, 2010, 50% of which vests on the completion of three years of service, and 50% of which vests based on the market price performance of the Company’s Common Stock at the completion of three years of service. |

(5) | Based on the closing market price of the Company’s Common Stock of $28.37 on September 30, 2011. |

After the grants of restricted stock during fiscal 2011, there are 73,938 shares of common stock available under the 2010 Restricted Stock shall provide for a deferral of compensation within the meaning of section 409A of the Code.

|

10.4.Governing Law.The provisions of the Plan for future grantsand all Sales of restricted stock. Communications with the Board of Directors

The Company provides an informal process for shareholdersRestricted Stock made hereunder shall be governed by and other interested parties to send communications to its Board. Shareholders or other interested parties who wish to contact the Lead Independent Director, the outside directors as a group, or any of its individual members may do so by writing to: Board of Directors, Panhandle Oil and Gas Inc., 5400 N. Grand Boulevard, Suite 300, Oklahoma City, OK 73112-5688. Correspondence directed to any individual Board member is referred, unopened, to that member. Correspondence not directed to a particular Board member is referred, unopened, to the Lead Independent Director.

Shareholder Proposals

Proposals of shareholders intended to be presented at the next annual shareholders meeting to be held in March 2013, and to be included in the proxy statement and form of proxy pursuant to Rule 14a-8 under the Securities and Exchange Act of 1934, must be received by the Company by October 1, 2012. Any such proposals should be in writing and be sent by certified mail, return receipt requested, to the Company’s office at the address shown below under the caption “Form 10-K”, Attention: Secretary. On receipt of any such proposal, the Company will determine whether or not to include such proposal in the proxy statement and any proxyinterpreted in accordance with regulations governing the solicitation of proxies.